TSC German Property Income Fund

Investment Objective

Acquire yield generating senior housing properties in Germany, rented out under long term contracts to top tier nursing home operators.

Investment Strategy

A unique investment proposition combining current cash flow and capital appreciation in a growing and uncorrelated sector.

Build up a critical mass portfolio of quality senior housing assets sufficiently large to attract institutional investors willing to pay a premium to access sizeable portfolios in this emerging and still fragmented asset class.

The fund has been launched in 2010, has concluded the investment phase and today manages a portfolio of 14 properties.

Nursing Homes Market: anticyclical, growing and recession-proof

- Sector mainly driven by natural demographic demand and resilient to the economy and markets

- Regulated and government supported by the leading European country

- German senior housing market expanded twice faster than GDP in the last 10 years and it is expected to grow at 5% p.a. until 2050

- Long term leases (25 years) indexed to CPI (inflation protection)

- Attractive acquisition yields (7-8%p.a.) compared to other developed markets (150-200 bps)

- Price per sqm (EUR 1,500 per sqm) lower than replacement cost

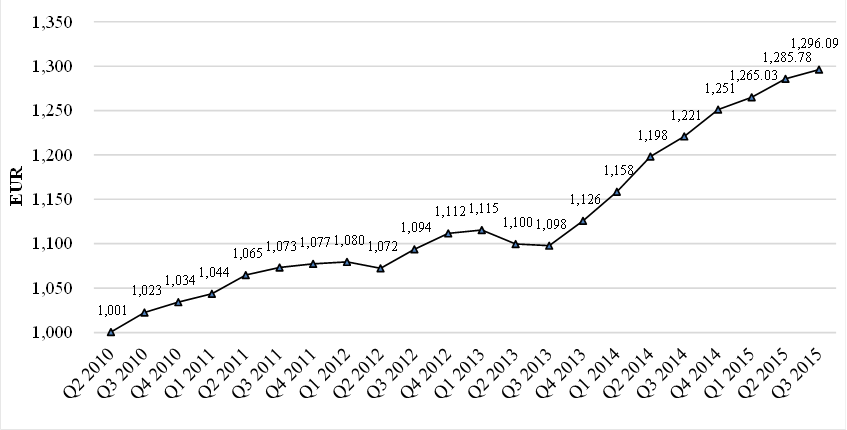

Quarterly Adjusted NAV per share (*)

Current portfolio

Pohlheim |

|

| Region: | Hesse |

| Sqm: | 3,200 |

| Beds: | 79 |

| Tenant: | – |

| Type of rent: | – |

[/hotspotitem]

[hotspotitem]

Wetzlar |

|

| Region: | Hesse |

| Sqm: | 10,971 |

| Beds: | 112 + 20 Apts |

| Tenant: | Alloheim |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Lübeck |

|

| Region: | Schleswig - Holstein |

| Sqm: | 4,565 |

| Beds: | 116 |

| Tenant: | Michael Bethke |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Sülzbach |

|

| Region: | Bavaria |

| Sqm: | 5,500 |

| Beds: | 119 |

| Tenant: | Procurand |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Bielatal |

|

| Region: | Saxony |

| Sqm: | 4,573 |

| Beds: | 80 |

| Tenant: | AGO |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Strausberg |

|

| Region: | Brandenburg |

| Sqm: | 12,275 |

| Beds: | 139 + 75 Apts |

| Tenant: | Procurand |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Bad Elster |

|

| Region: | Saxony |

| Sqm: | 8,788 |

| Beds: | 110 + 9 Apts |

| Tenant: | Alloheim |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Igersheim |

|

| Region: | Baden-Wüttemberg |

| Sqm: | 6,055 |

| Beds: | 114 |

| Tenant: | Phönix (Korian Group) |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Mainaschaff |

|

| Region: | Bavaria |

| Sqm: | 5,377 |

| Beds: | 127 |

| Tenant: | Phönix (Korian Group) |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Lehrte 1-2 |

|

| Region: | Lower Saxony |

| Sqm: | 8,765 |

| Beds: | 134 + 10 Apts |

| Tenant: | Procuritas |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Bad Sooden |

|

| Region: | Hesse |

| Sqm: | 7,940 |

| Beds: | 132 |

| Tenant: | Senator |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Berlin |

|

| Region: | Berlin |

| Sqm: | 6,867 |

| Beds: | 141 |

| Tenant: | Pro Seniore |

| Type of rent: | double net |

[/hotspotitem]

[hotspotitem]

Stemwede |

|

| Region: | N.R. West Phalia |

| Sqm: | 3,602 |

| Beds: | 80 |

| Tenant: | Procuritas |

| Type of rent: | double net |

[/hotspotitem][/cq_vc_hotspot]