THREESTONES CAPITAL MANAGEMENT S.A.

Threestones Capital is a fast growing independent investment management group headquartered in Luxembourg. The company manages private equity real estate regulated investment vehicles under de supervision of the Luxembourg financial authorities (CSSF) in compliance with European financial regulations.

Threestones Capital Management SA is an AIFM (Alternative Investment Fund Manager) in accordance with the AIFM Directive

FOCUS ON NICHE ASSET CLASS

teaser_1

In evaluating private equity investments, Threestones Capital looks for asset classes with stable and predictable cash flows,...

READ MORE

A TWO-FOLD INVESTMENT STRATEGY

teaser_2

In devising the investment strategy and select invest-

ment markets, the company privileges a top-down approach recognising that business...

READ MORE

HANDS-ON DIRECT MANAGEMENT

teaser_3

Threestones believes in “hands-on” direct investment management and detailed control of operations. and applies a vertically integrated...

READ MORE

THREESTONES CAPITAL MANAGEMENT S.A.

Threestones Capital is a fast growing independent investment management group headquartered in Luxembourg. The company manages private equity real estate regulated investment vehicles under de supervision of the Luxembourg financial authorities (CSSF) in compliance with European financial regulations.

Threestones Capital Management SA is an AIFM (Alternative Investment Fund Manager) in accordance with the AIFM Directive

FOCUS ON NICHE ASSET CLASS

teaser_1

In evaluating private equity investments, Threestones Capital looks for asset classes with stable and predictable cash flows,...

READ MORE

A TWO-FOLD INVESTMENT STRATEGY

teaser_2

In devising the investment strategy and select invest-

ment markets, the company privileges a top-down approach recognising that business...

READ MORE

HANDS-ON DIRECT MANAGEMENT

teaser_3

Threestones believes in “hands-on” direct investment management and detailed control of operations. and applies a vertically integrated...

READ MORE

THREESTONES CAPITAL MANAGEMENT S.A.

Threestones Capital is a fast growing independent investment management group headquartered in Luxembourg. The company manages private equity real estate regulated investment vehicles under de supervision of the Luxembourg financial authorities (CSSF) in compliance with European financial regulations.

Threestones Capital Management SA is an AIFM (Alternative Investment Fund Manager) in accordance with the AIFM Directive

FOCUS ON NICHE ASSET CLASS

teaser_1

In evaluating private equity investments, Threestones Capital looks for asset classes with stable and predictable cash flows,...

READ MORE

A TWO-FOLD INVESTMENT STRATEGY

teaser_2

In devising the investment strategy and select invest-

ment markets, the company privileges a top-down approach recognising that business...

READ MORE

HANDS-ON DIRECT MANAGEMENT

teaser_3

Threestones believes in “hands-on” direct investment management and detailed control of operations. and applies a vertically integrated...

READ MORE

INVESTMENT STRATEGY AND MANAGEMENT APPROACH

FOCUS ON “NICHE” SECTORS AND ASSET CLASSES

In evaluating private equity investments, Threestones Capital looks for asset classes with stable and predictable cash flows, positive supply/demand fundamentals, a favorable demographic profile, and assets with potential to generate capital gains over 5 to 7 years. Threestones Capital aims to identify investments in “niche” growing asset classes or industries which are reasonably priced and to build portfolios / execute “build-up” strategies aimed to achieve critical mass or significant market position to make the investment attractive to international strategic players, institutions or public markets.

A TWO-FOLD INVESTMENT STRATEGY

In devising the investment strategy and select investment markets, the company privileges a top-down approach recognising that business cycles are influenced by major global and local economic indicators. As far as the execution of the investment strategy is concerned, Threestones believes that local market knowledge and execution strength (deal sourcing, deal negotiations and operation management) are critical factors to successful investments.

HANDS-ON DIRECT MANAGEMENT

Threestones believes in “hands-on” direct investment management and detailed control of operations. and applies a vertically integrated operations management approach. Threestones Capital is managed by its 3 founding partners who are engaged full-time in the business and are aligned with investor’s interests.

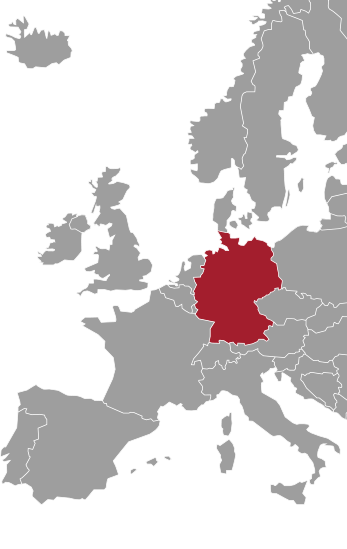

The Fund’s strategy was to selectively acquire nursing home properties leased with LT contracts to a number of leading healthcare operators and to sell them as a “portfolio” to an institutional investor within a 5-7 years period. The Fund aggregated a diversified portfolio of 14 quality nursing homes leased to 7 operators across Germany which was successfully sold to a European institutional investor for EUR 138 million in 2016, fully realizing the initially projected performance. The Fund achieved an overall return of 162% and in excess of 13% Net IRR.

TSC GERMAN PROPERTY INCOME FUND

Investment Objective

Acquire yield generating senior housing properties in Germany, rented out under long term contracts to top tier nursing home operators.

Investment Strategy

A unique investment proposition combining current cash flow and capital appreciation in a growing and uncorrelated sector.

Build up a critical mass portfolio of quality senior housing assets sufficiently large to attract institutional investors willing to pay a premium to access sizeable portfolios in this emerging and still fragmented asset class.

The fund has been launched in 2010, has concluded the investment phase and today manages a portfolio of 14 properties.

CURRENT PORTFOLIO

Nursing Homes Market: anticyclical, growing and recession-proof

Sector mainly driven by natural demographic demand and resilient to the economy and markets

Regulated and government supported by the leading European country

German senior housing market expanded twice faster than GDP in the last 10 years and it is expected to grow at 5% p.a. until 2050

Long term leases (25 years) indexed to CPI (inflation protection)

Attractive acquisition yields (7-8%p.a.) compared to other developed markets (150-200 bps)

Price per sqm (EUR 1,500 per sqm) lower than replacement cost

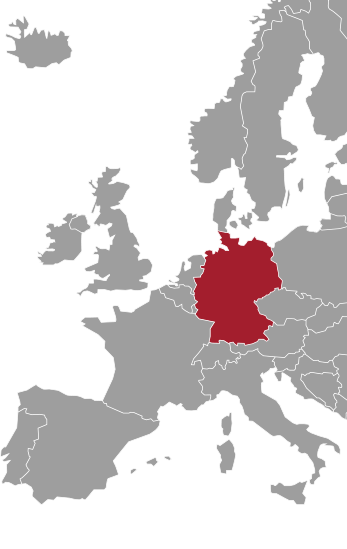

GEFCARE REAL ESTATE FUND

Investment Objective

Acquire yield generating senior housing properties in Germany, rented out under long term contracts to top tier nursing home operators.

Expected portfolio: 15-20 properties with 1,600-2,000 beds.

Investment Strategy

A unique investment proposition combining current cash flow and capital appreciation in a growing and uncorrelated sector.

Build up a critical mass portfolio of quality senior housing assets sufficiently large to attract institutional investors willing to pay a premium to access sizeable portfolios in this emerging and still fragmented asset class.

CURRENT PORTFOLIO

Nursing Homes Market: anticyclical, growing and recession-proof

Sector mainly driven by natural demographic demand and resilient to the economy and markets

Regulated and government supported by the leading European country

German senior housing market expanded twice faster than GDP in the last 10 years and it is expected to grow at 5% p.a. until 2050

Long term leases (25 years) indexed to CPI (inflation protection)

Attractive acquisition yields (7-8%p.a.) compared to other developed markets (150-200 bps)

Price per sqm (EUR 1,500 per sqm) lower than replacement cost

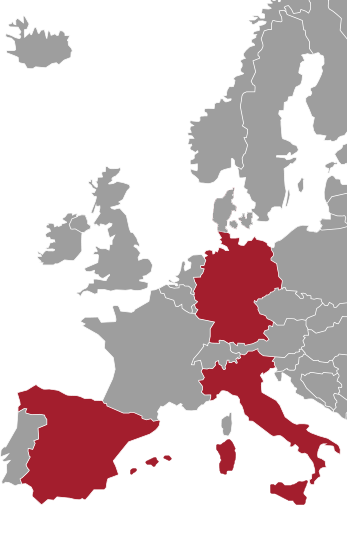

TSC EUROCARE REAL ESTATE

Investment Objective

Acquire yield generating senior housing properties in Europe, rented out under long term contracts to top tier nursing home operators.

Investment Strategy

A unique investment proposition combining recurring cash flow and capital appreciation in a growing and uncorrelated sector. 2/3 of expected performance generated by recurring cash flow.

Build up a critical mass portfolio of quality senior housing assets sufficiently large to attract institutional investors willing to pay a premium to access sizeable portfolios in this emerging and still fragmented asset class.

The fund has been launched in July 2016 and is accepting subscriptions form investors.

Nursing Homes Market: anticyclical, growing and recession-proof

Sector mainly driven by natural demographic demand and resilient to the economy and markets

Regulated and subsidised by the governments of European countries

Long term leases (>15 years) indexed to CPI (inflation protection)

Attractive acquisition yields (6-8% p.a.) compared to other developed markets

Price per sqm (EUR 1,500 per sqm) lower than replacement costTSC FUND BERLIN RESIDENTIAL

Investment Objective

The Fund invests in yield producing quality residential properties in the Berlin city centre and will seek to achieve capital appreciation over the medium term through active management and rents growth, while collecting current rents.

Investment Strategy

yield producing properties with (if possible) some vacancy (20-30%)

Rent below current market level

Price/sqm: EUR 1,500 (average)

The fund invests in stabilized income generating properties in Berlin’s prime central and emerging locations offering upside potential with the following main investment criteria:

This strategy offers a unique investment proposition combining current cash flow with capital gain potential

CURRENT PORTFOLIO

Key Drivers of Performance

Renting of vacant space at current market level: old rent agreements 50% below current market

Rent increase through property improvements: common spaces, energy savings programs, façade, lift, etc.

Increase of rentable area: top floor (roof) permitted by law,…

Quarterly Adjusted NAV per share (*)