The Fund’s strategy was to selectively acquire nursing home properties leased with LT contracts to a number of leading healthcare operators and to sell them as a “portfolio” to an institutional investor within a 5-7 years period. The Fund aggregated a diversified portfolio of 14 quality nursing homes leased to 7 operators across Germany which was successfully sold to a European institutional investor for EUR 138 million in 2016, fully realizing the initially projected performance. The Fund achieved an overall return of 162% and in excess of 13% Net IRR.

TSC German Property Income Fund

Investment Objective

Acquire yield generating senior housing properties in Germany, rented out under long term contracts to top tier nursing home operators.

Investment Strategy

A unique investment proposition combining current cash flow and capital appreciation in a growing and uncorrelated sector.

Build up a critical mass portfolio of quality senior housing assets sufficiently large to attract institutional investors willing to pay a premium to access sizeable portfolios in this emerging and still fragmented asset class.

The fund has been launched in 2010, has concluded the investment phase and today manages a portfolio of 14 properties.

Nursing Homes Market: anticyclical, growing and recession-proof

- Sector mainly driven by natural demographic demand and resilient to the economy and markets

- Regulated and government supported by the leading European country

- German senior housing market expanded twice faster than GDP in the last 10 years and it is expected to grow at 5% p.a. until 2050

- Long term leases (25 years) indexed to CPI (inflation protection)

- Attractive acquisition yields (7-8%p.a.) compared to other developed markets (150-200 bps)

- Price per sqm (EUR 1,500 per sqm) lower than replacement cost

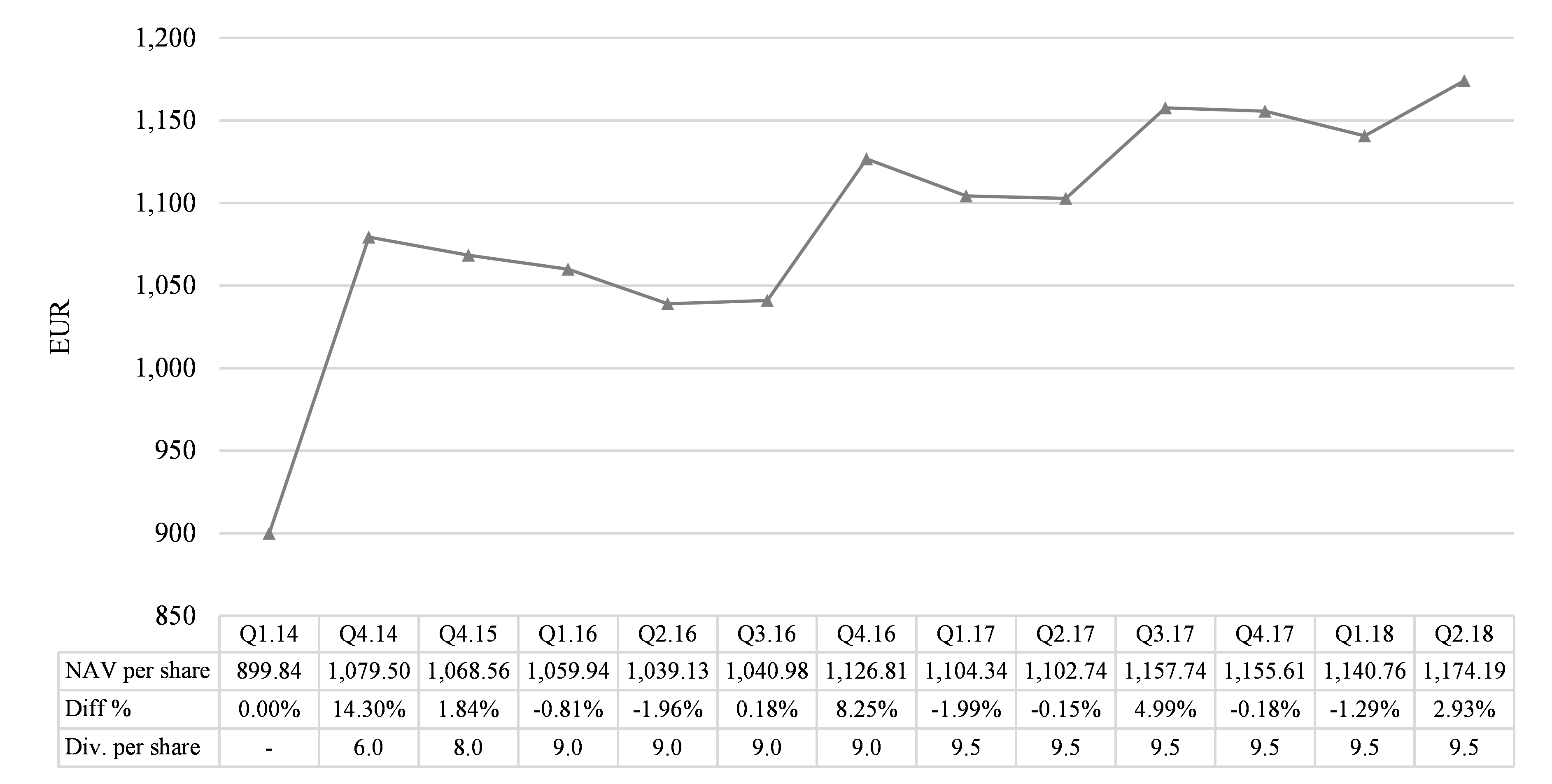

Quarterly Adjusted NAV per share (*)